1. Instant Payable Intelligence with AI

The past is of manual data entry. HelloPay AI payable software enables companies to scan, categorize, and schedule payments within seconds and with little human interference. Using our AI accounting platform, we can read invoice structures, find anomalies, and learn gradually to get more accurate. Automation is not the only thing; it is a smart action.

You can be an expanding startup or an enterprise dealing with MSMEs. HelloPay has the payable automation solutions, which save time and reduce the errors cum consuming costs. View and manage all through our mobile dashboard and keep control wherever the job is. HelloPay makes AP more intelligent, quicker, and completely streamlined, which allows your finance department to become more strategic.

2. GST Ready by Design

Sick of GST mismatch and tedious tax filings? The unique feature of HelloPay is that it is an AI-based payable automation solution that is GST-ready, out of the box; hence, Indian businesses have flawless compliance. Automatically pull the GST fields off bills, map them in a correct manner, and produce pre-tax reports without any spreadsheets or re-keying or re-work.

HelloPay is built keeping in mind the compliance of the MSMEs and guaranteeing the accuracy of its tax data, quicker GST reconciliation, and calm nights during an audit. Regardless of whether it is CGST, SGST, or IGST, your data is dealt with accurately. Our AI accounting platform, HelloPay, brings a new level to the way you handle taxes, helping you save hundreds of hours and keep 100 percent compliant.

3. Faster Approvals & Paperless Workflow

In accounts payable, speed and control are important. HelloPay provides a guarantee through AI-based invoice approval processes, which relieve bottlenecks and delays. Auto-forward bills to the correct approvers, generate reminders, and have the digital audit trail without chasing signatures or sifting through your email.

HelloPay payable automation, with its operations focused on MSMEs, is one way that introduce agility in your financial process. Mobile dashboard tracks all the approvals and gives decision-makers the necessary information on the move, making them responsive. HelloPay offers a paperless, efficient, and scalable workflow, and because onboarding is easy, your team is ready to go in no time.

4. Real-Time Web-Based Mobility Dashboards

Payables in the current hectic world are not available at a desk. Hello, Pay AI invoice payable software will help manage, approve, and track your invoices at any location using the user-friendly mobile application panel. You can connect and be in control whether you are in a meeting with a client or moving around.

Receive due date, pending approval, and payment status alerts on mobile instantly. Track cash flow patterns, sign off with a tap and say goodbye to missed payments, no matter where you are. HelloPay is an MSME-focused solution to ensure mobility and real-time financial visibility at your fingertips with a technological accounting platform based on powerful AI.

5. Effortless Vendor Management

The lack of organization in vendor records may result in paying twice, delays, and a violation threat. The answer to that is HelloPay which has AI-powered duplicate detection and vendor normalization to make sure that your vendor data is clean, accurate and audit ready at all times.

The documentation of all vendors, their payment history, and other information is available in a centralized location using our payable automation product. Farewell to the mucky inbox and sea of spreadsheets, all your necessities are within touching distance of your dashboard on your frictionless mobile interface.

Add money to the payment industry- HelloPay is a perfect solution to MSME-targeting finance teams, the communication system is optimized, vendor matching is automated, and all transactions are intelligently connected with the correct supplier without the need to raise additional parties to simplify the whole process.

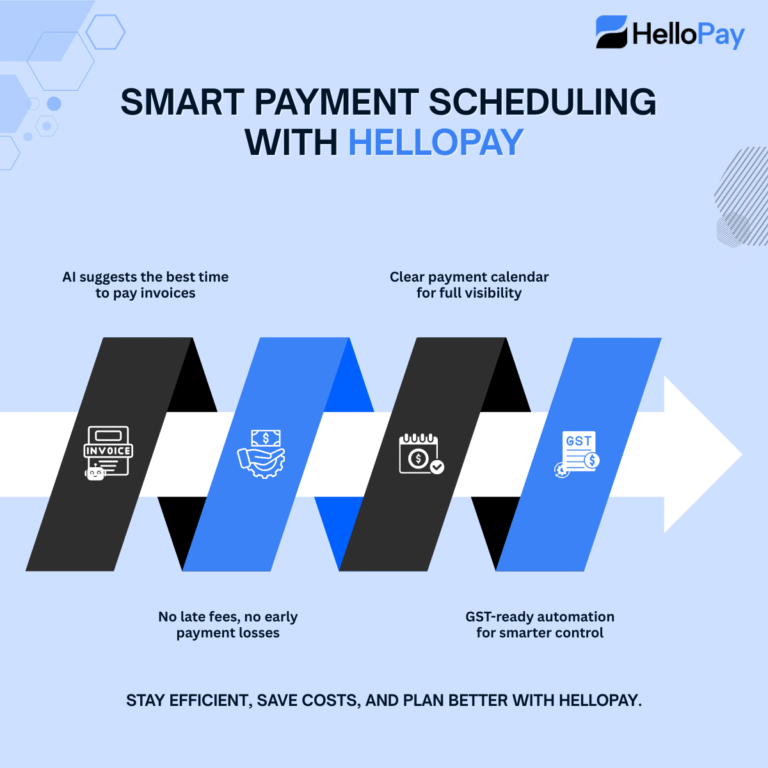

6. Smart Payment Scheduling

In accounts payable, timing is all. HelloPay analyzes the real time data of users to auto suggest the most efficient time of paying invoices-keeping in mind the due dates of invoices and the availability of cash at that time. The result? There are no late fees, no loss on early payments anymore, and no surprises on month-end.

Finance teams have a pictorial view of all pending liabilities with payment calendar integration, thus making planning smarter. HelloPay is an AI accounting platform that learns your payables pattern and the best and economical strategy.

It does not matter whether you are an MSME on the growth path or just in the risk-reduction game, our intelligent GST-ready payable automation solution provides full visibility and proactive control.

7. Easy Onboarding & Integration

Automating startup should not be difficult. Onboarding with Hello Pay AI payable software is easy, simple, and MSME-driven. No complex learning processes and cycles of setting up, only simple onboarding to suit any real-world finance movements.

HelloPay is easily connected to your existing ERP, accounting tools, and the data will be kept in sync to make the transitionery. Our AI-based interface takes them through each process and eradicates any friction, thereby cutting the reliance on IT departments.

To automate payment in a growing business, HelloPay has just the flavour- a workable automation of payments that can be as easy as it can be intelligent.

8. Actionable Reports & Insights

Starting to make decisions based on data means becoming visible. HelloPay provides immediate usable insights that is delivered in customized reports based on your business requirements. Assign and track vendor, category, due date, GST liability and many more on a central mobile dashboard.

Graphical dashboards provide an overview of the assets of a CFO, and it is simple to observe cash flow, identify anomalies and initiate payments. Create and export board ready summaries with a couple clicks.

HelloPay is an AI accounting solution that can deliver apt strategies based on intricate data that can enable MSME-dependent teams to eliminate guesspeople and spreadsheets. Give your finance leaders the power to pro-act.

9. Fraud Detection & Compliance

Modern AP is all about security and trust. HelloPay has in-app fraud detection, which applies AI to highlight unusual invoice value, duplicate entries, or suspicious vendors so they do not affect your books.

Ensure that there is internal control of a high standard such as user-based access controls, levels of approval, and an audit trail that is comprehensive and has high transparency in each step of the process. Being GST-ready, HelloPay will make tax compliance easier to Indian businesses, as the fields and formats used in regulatory reporting will be automatically validated.

HelloPay is a real peace of mind to the founders, CFOs, and controllers. Our payable automation solution covers your operations through end-to-end fraud mitigation to compliance assurance.

10. Scalable for MSMEs to Enterprises

HelloPay AI payable software has been designed to grow as your enterprise grows. As a startup with only a handful of payment bills per week or a large enterprise with 500+ invoices per week, you can expect Hello Pay AI to expand with you. With our cloud-first design, you will enjoy proper performance, speed, and security, no matter what the size of business you run.

HelloPay is versatile, which can be in a 10-member finance department and even multi-department workflows. Such capabilities as mobile dashboards, effortless onboarding, and integrations provide your team with the ability to remain efficient throughout all the development phases.

Being a GST-ready and MSME-centered payable automation software, HelloPay is a company that grows with you–without breaking the bank and/or intricate changes.